UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to |

Professional Diversity Network, Inc. | |||

(Name of Registrant as Specified in Its Charter) | |||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required. | ||

☐ | |||

Fee paid previously with preliminary materials. | |||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act | ||

May 1, 2024

Dear Stockholder:

On behalf of the Board of Directors, I am pleased to invite you to attend the 2016 annual meeting2024 Annual Meeting of stockholdersStockholders of Professional Diversity Network, Inc. (the “Company”). The meeting will be held in the main conference room at the Company’s offices of the Company located at 801 W. Adams55 E. Monroe Street, Suite 600,2120, Chicago, Illinois 60607,60603, on September 26, 2016,June 10, 2024, at 11:9:00 a.m., Central Time.

At the meeting, you and the other stockholders will be asked to vote on the proposals described in detail in the notice of meeting on the following page and the accompanying proxy statement, including the following matters: (i) the electionstatement. The proxy materials are being mailed on or about May 1, 2024, to our stockholders of seven directors to hold office until the next annual meetingrecord and until their successors are duly elected and qualified; (ii) the ratificationbeneficial owners as of the appointmentclose of Marcum LLP as our independent registered public accounting firm forbusiness on the fiscal year ending December 31, 2016; (iii) the approval of a series of alternate amendments to our certificate of incorporation, to effect,record date, April 17, 2024.

It is important that your shares be represented and voted at the discretion of our Board of Directors, a reverse stock split of our common stock, whereby each outstanding 2 through 15 shares would be combined, converted and changed into one share of our common stock (the “Reverse Stock Split Proposal”) and to reduce proportionally the number of shares of common stock the Company is authorized to issue; and (iv) such other business as may properly be brought before the meeting or any adjournment or postponement thereof.

Thank you for your continued interest in the Company. We look forward to seeing you at the meeting.

Sincerely, | |

| |

/s/ Xin (Adam) He | |

Xin (Adam) He | |

Chief Executive |

PROFESSIONAL DIVERSITY NETWORK, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 10, 2024

TO OUR STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the Annual Meeting of the Board of Directors, I am pleased to invite you to attend the 2016 annual meeting of stockholdersStockholders (the “Annual Meeting”) of Professional Diversity Network, Inc., a Delaware corporation (the “Company”). The meeting, will be held in the main conference room at the Company’s offices, of the Company, 801 W. Adamsat 55 E. Monroe Street, Suite 600,2120, Chicago, Illinois 60607,60603, on September 26, 2016,June 10, 2024, at 11:9:00 a.m., Central Time. AtTime, for the meeting you will be asked to:

1. To elect five (5) directors |

2. To ratify the appointment by the Company's Audit Committee of Sassetti, LLC as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2024;

3. To conduct an advisory vote on the proposals related to the pending acquisition by Cosmic Forward Limited, a Republic of Seychelles company (“CFL”) of 51% of sharescompensation of our common stock on a fully diluted basis. You will receive separate materials with respect to a special meeting of stockholders to be held at a later date determined by our Board of Directors, tonamed executive officers;

4. To conduct an advisory vote on the frequency of future advisory votes on the compensation of our named executive officers; and

5. To transact such proposals.

The Board of Directors has fixed the close of business on August 4, 2016April 17, 2024 as the record date for the determination of the holders of our common stock entitled to notice of and to vote on all matters presented at the 2016 annual meeting of stockholdersAnnual Meeting and at any adjournments or postponements.

A list of stockholders entitled to vote at the 2016 annualAnnual Meeting will be open for examination by any stockholder for any purpose germane to the meeting during ordinary business hours for a period of stockholdersten days prior to the Annual Meeting at the Company’s offices, at 55 E. Monroe Street, Suite 2120, Chicago, Illinois 60603, and will also be available for examination by any stockholder at the Annual Meeting until its adjournment.

Your vote is very important. Please submit your proxy as soon as possible by using the Internet, telephone or mail. Submitting your proxy by one of these methods will ensure your representation at the Annual Meeting regardless of whether you attend the size of your holdings. Whether or notmeeting. Even if you plan to attend the meeting, please vote electronically via the Internet, by telephone or by completing, signing, dating and returning theAnnual Meeting, we recommend that you submit your proxy card included with a paper copy of theas described in proxy statement as promptly as possible. Voting electronically or returningso that your proxy does NOT deprivevote will be counted if you of your rightare unable to attend the meeting and to vote your shares in personAnnual Meeting.

Proxy materials for the matters acted upon atAnnual Meeting will be distributed to holders of our common stock via the meeting.

| |

Stockholders who prefer to receive a paper copy of our proxy materials, should follow the instructions included in the Notice.

Important Note Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held June 10, 2024:

Copies of the proxy statement and of our annual report for the fiscal year ended December 31, 2023 are available online at www.proxyvote.com free of charge.

By Order of the | ||

/s/ Hao (Howard) Zhang | ||

Hao (Howard) Zhang | ||

Chairman of the Board |

Chicago, Illinois

May 1, 2024

PROFESSIONAL DIVERSITY NETWORK, INC.

PROXY STATEMENT

PROPOSAL 3: ADVISORY VOTE ON EXECUTIVE COMPENSATION (Say-On-Pay) | |

| ADVISORY VOTE ON FREQUENCY OF FUTURE ADVISORY VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS (Say-On-Frequency) | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

Chicago, IL 60607

ANNUAL MEETING

To Be Held on June 10, 2024

The enclosed proxy is solicited by and on behalf of the board of directors (the “Board”) of Professional Diversity Network, Inc., a Delaware corporation (“Professional Diversity Network,” the “Company” or “PDN”), for use at Professional Diversity Network’s 2024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on September 26, 2016

We anticipate that mailing of this proxy statement and Related Mattersform of proxy to our stockholders, or the mailing of the Notice of Internet Availability of Proxy Materials, will commence on or about May 1, 2024. This proxy statement and the form of proxy relating to the Annual Meeting will also be made available on the Internet to stockholders on the date that the proxy materials are first sent.

Record Date and Outstanding Shares

The Board has fixed the close of business on April 17, 2024 as the record date for the Annual Meeting (the “Record Date”). Only holders of record of the Company’s common stock, $0.01 par value per share (“Common Stock”), at the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting. Each holder of Common Stock on the Record Date is entitled to one vote for each share on all matters to be voted upon at the Annual Meeting. As of the close of business on the Record Date, there were approximately 11,492,225 shares of Common Stock outstanding and entitled to vote.

Quorum and Vote Required

Quorum. The holders of record of a majority of the aggregate voting power of the Common Stock issued and outstanding and entitled to be voted, present in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting or any adjournment or postponement thereof. In the event there are not sufficient shares present to establish a quorum or to approve proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies by the Company.

Vote Required. Holders of Common Stock are entitled to one vote for each share held as of the Record Date on all matters to be voted on. In the election of directors (Proposal 1), the Board will be elected by a plurality of the voting power of the Common Stock represented in person or by proxy and entitled to vote at the Annual Meeting. Each stockholder is entitled to vote in favor or withhold his, her or its vote with respect to each individual nominee or all nominees. Votes that are withheld will have no effect on the outcome of the election of directors. The Company’s Bylaws provide that, except as otherwise provided by applicable law, the Company’s Certificate of Incorporation or the Bylaws, all matters other than the election of directors will be decided by the vote of a majority in voting power of the shares present in person or by proxy and entitled to vote at the Annual Meeting and on the matter, provided that a quorum is present. Consequently, the affirmative vote of a majority in voting power of the shares present in person or by proxy and entitled to vote at the Annual Meeting and on such proposal is required to approve Proposal 2 (Ratifying the Selection of Auditing Firm) and Proposal 3 (Advisory Vote on Executive Compensation). For the advisory vote on the frequency of future advisory votes on executive compensation (Proposal 4), the option that receives the highest number of votes cast by stockholders will be the frequency considered to have been selected by the stockholders.

Abstentions and Withheld Votes. Abstentions and (in the case of director elections) withheld votes will be counted for purposes of determining a quorum at the Annual Meeting. Withheld votes will have no effect on the outcome of Proposal 1 (Election of Directors). Abstentions will have the same effect as a vote against Proposal 2 (Ratifying the Selection of Auditing Firm), and Proposal 3 (Advisory Vote on Executive Compensation) and will have no effect on Proposal 4 (Advisory Vote on Executive Compensation Review Frequency).

Broker Discretionary Voting. If your shares are held in a brokerage account, by a brokerage firm, bank trustee or other agent (“nominee,”), you are considered the “beneficial owner”beneficial owner of shares held in street name.“street name,” and the proxy materials are being sent to you by your broker, bank or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote. If you do not give instructions to your brokerage firm or bank, it will still be able to vote your shares with respect to “discretionary” proposals, but will not be allowed to vote your shares with respect to “non-discretionary” proposals. The Company expects that Proposal 2 (Ratifying the Selection of Auditing Firm) will be considered to be a discretionary proposal on which banks and brokerage firms may vote. The Company expects that all other proposals being presented to stockholders at the Annual Meeting will be considered to be non-discretionary items on which banks and brokerage firms may not vote without instruction. Therefore, if you do not instruct your broker or bank regarding how you would like your shares to be voted, your bank or brokerage firm will not be able to vote on your behalf with respect to these proposals. In the case of these non-discretionary items, the shares will be treated as “broker non-votes.” Broker non-votes are shares that are held in “street name” by followinga bank or brokerage firm that indicates on its proxy that it does not have discretionary authority to vote on a particular matter. Your failure to give instructions to your bank or broker will not affect the outcome of Proposal 1 (Election of Directors). Likewise, because broker non-votes are not deemed entitled to vote on Proposal 3 and will not be voted on Proposal 4, they will have no effect on the outcome of these proposals.

Shares Not Present in Person or by Proxy at the Annual Meeting. Shares not present in person or by proxy at the Annual Meeting will not be counted for purposes of determining a quorum at the Annual Meeting and will have no impact on the outcome of any of the proposals to be voted upon at the Annual Meeting.

Expenses of Proxy Solicitation

Officers, directors and other employees of the Company may solicit proxies in person or by regular mail, electronic mail, facsimile transmission or personal calls. These persons will receive no additional compensation for solicitation of proxies, but may be reimbursed for reasonable out-of-pocket expenses.

The Company will pay all of the expenses of soliciting proxies to be voted at the Annual Meeting. Banks, brokerage firms and other custodians, nominees or fiduciaries will be requested to forward soliciting material to their instructionsprincipals and to obtain authorization for the execution of proxies. They will be reimbursed for their reasonable out-of-pocket expenses incurred in that regard.

Voting Methods

Your vote is important. You may vote on the Internet, by telephone, by mail or by attending the Annual Meeting and voting by ballot, all as described below. If you vote by telephone or on the Internet, you do not need to return your proxy card or ifvoting instruction card. Telephone and Internet voting facilities are available now and will be available 24 hours a day until 11:59 p.m., Eastern Time, on June 9, 2024.

Vote on the Internet

If you specifically request a copy of the printed materials from your nominee,have Internet access, you may usesubmit your proxy by going to www.proxyvote.com and following the voting instruction cardinstructions provided on the secure website. If you vote on the Internet, you do not have to mail in a proxy card.

Vote by Telephone

You can also vote by telephone by calling 1-800-690-6903. Easy-to-follow voice prompts allow you to vote your nominee.

Vote by telephoneMail

If you received printed proxy materials and choose to vote by mail, are set forth on yourcomplete, sign and date the proxy card.

Vote at the voting proceduresAnnual Meeting

The method or timing of your nominee. Ifvote will not limit your right to vote at the Annual Meeting if you attend the Annual Meeting and vote in person. However, if your shares are held byin the name of a bank, broker or other nominee, and you intendmust obtain a legal proxy, executed in your favor, from the holder of record to be able to vote at the meeting, please bringAnnual Meeting. You should allow yourself enough time prior to the Annual Meeting to obtain this proxy from the holder of record.

If you submit a proxy by telephone or via the Internet you should not return the proxy card included with a paper copy of this proxy statement. If you evidencehold your shares through a bank, broker or other nominee you should follow the voting instructions you receive from your bank, broker or other nominee.

Revocability of Proxy

If you are the holder of record for your ownershipshares, you may revoke your proxy at any time before it is exercised at the Annual Meeting by taking either of the following actions: (i) delivering to the Company’s Secretary a revocation of the proxy or a new proxy relating to the same shares and bearing a later date prior to the vote at the Annual Meeting; or (ii) attending the Annual Meeting and voting in person, although attendance at the Annual Meeting will not, by itself, revoke a proxy. Stockholders may also revoke a prior proxy submitted by telephone or on the Internet by providing later voting instructions for voting of a later proxy prior to 11:59 P.M. Eastern Time the night of the last business day, June 9, 2024, before the date of the Annual Meeting.

Recommendation of the Board of Directors

The Board of Professional Diversity Network recommends that Professional Diversity Network stockholders vote FOR the election of each nominee for director (Proposal 1), FOR the ratification of the Company’s selection of Sassetti, LLC as the Company’s independent registered public accounting firm (Proposal 2), FOR the advisory vote on executive compensation (Proposal 3), and for the 1 Year option on the advisory vote on frequency of future advisory votes on the compensation of our names executive officers (Proposal 4).

PROPOSAL 1: NOMINATION AND ELECTION OF DIRECTORS

Nominees for Director

The Board has nominated the five persons listed below to be elected as directors at the Annual Meeting. Directors are to be elected by a plurality vote of the voting power of the Common Stock present in person or by proxy at the Annual Meeting to serve until the next Annual Meeting and until their successors have been duly elected and qualified. All of the nominees are currently members of the Board.

The following table provides the name, age and position of each of our nominees of the Board as of the record date (such as a letter from your nominee confirming your ownershipof this proxy statement. There are no family relationships between our executive officers and directors or a bank or brokerage firm account statement) and a legal proxy from your nominee authorizing you to vote your shares.

Name | Age | Position |

Michael D. Belsky | 65 | Director (1), (2), (3) | ||

Ge Yi | 48 | Director (3) | ||

Chris Renn | 52 | Director (1) | ||

Courtney Shea | 63 | Director (1), (2) | ||

Hao (Howard) Zhang | 56 | Director (2), (3), Chairman of the |

(1) | ||

Member of our audit committee. | ||

(2) | ||

Member of | ||

(3) | Member of our nominating and corporate governance committee | |

Set forth below is authorized to issue.

Michael D. Belsky has been a member of the Board since January 2018. Michael joined EKI Digital Consulting and its related company Quant 16 as a Managing Principal in 2023. Before that, Michael was the inaugural Executive Director of the Center for Municipal Finance at the University of Chicago Harris School of Public Policy. He developed a Certificate in Municipal Finance, taught capital budgeting, created an executive education program, and ran an annual CFO Forum. Mr. Belsky was previously the Managing Director for Fixed Income at Greenwich Investment Management, a firm specializing in High Yield Municipal Bonds. Prior to joining the firm he worked in the municipal finance industry for over 30 years. From 2009 to 2011 he developed a credit review process for Chicago-based C.W. Henderson and Associates, a $3 billion municipal bond investment advisory firm. Mr. Belsky spent most of his career as Group Managing Director of the Public Finance Group at Fitch Ratings. He worked at the rating agency from 1993 to 2008 and was named top rating agency executive in public finance by Cosmic Forward Limited,institutional investors three years in a Republicrow (Smith’s Research and Ratings Review Municipal All Star Team, 2005–07). Mr. Belsky also served two terms as a member of Seychelles company (“CFL”)the City Council in Highland Park, Illinois (1995–2003), and two terms as mayor (2003–11). Under his leadership the city received national recognition in the areas of 51%environmental sustainability, budgeting, financial reporting, affordable housing and local health initiatives. The city maintained a triple-A rating by Moody’s Investors Service throughout his tenure. From 2008 to 2011 Mr. Belsky was a member of sharesthe Governmental Accounting Standards Board, a national body that sets accounting and financial reporting standards for state and local governments. Mr. Belsky received a BA in urban studies from Lake Forest College and an MA in public policy from the University of Chicago. The Board believes that Mr. Belsky is a valuable addition to the Board in light of his extensive background in finance and public service.

Ge Yi has been a member of our common stockBoard since March 2024. Mr. Yi has over 20 years of experience and expertise in the technology industry, spanning product marketing, payment systems, sales, account management, fundraising, and global partnership development and maintenance. He embarked on his career journey at FedEx Internet Solutions Group in the Asia Pacific Headquarters in Singapore in 2000. Following this, he served as the Joint Engineering Team (JET) chair and lead engineer at Intel Assembly and Testing Group for 4 years. Subsequently, he assumed leadership of the product marketing team at Telegent System, a fully diluted basis. You will receive separate materials with respectstartup based in Sunnyvale, from 2007 to 2011. From 2012 to 2020, Mr. Yi played a special meetingpivotal role in driving international business growth at WeChat Marketing group. He served as the head of stockholdersWeChat Pay Americas and held the position of senior account executive in its cloud computing and technology group in recent years. From 2012 to be heldthe present, Mr. Yi has been a partnership and account manager executive at Tencent America. Mr. Yi holds a later date determined by our BoardBachelor's Degree from Tsinghua University and a Master of Directors, to vote on such proposals.

Chris Renn has been a member of Directors

Courtney C. Shea joined our Board in March 2019. She has over 30 years of professional experience in municipal advisory and investment banking. Ms. Shea retired in April 2021 as a managing member of Columbia Capital Management, LLC, which she joined in 2013. She served as the head of Chicago office and senior vice president at Acacia Financial Group, Inc. from 2009 to 2013. She was also the head of Chicago office and managing director of Siebert Branford Shank & Co, LLC from 2006 to 2008. She served as the national department manager at LaSalle Financial Services from 2001 to 2006. Ms. Shea has been a member of the Board of Assured Guaranty (NYSE; AGO) since 2021 and a member of the Joffrey Ballet since 2013. She chaired the Illinois State Securities Advisory Committee from 1995 to 1998 and was a member there from 1991 to 1995. She was also a member of the State of Illinois Banking Board from 2001 to 2002. In addition, Ms. Shea established the National Women in Public Finance as a co-founder in 1996. Ms. Shea received her MBA degree from the University of Chicago in 1985, her Juris Doctor degree from Loyola University Law School in 1983 and her bachelor’s degree in economics from University of Notre Dame in 1980. She has been a member of the board of directors of Assured Guaranty (NYSE: AGO) since 2021. The Board believes that Ms. Shea is a valuable asset to the Board in light of her legal background and her substantial experiences in public finance.

Hao (Howard) Zhang has been a member of the Board since November 2016, further elected as the Chairman of the Board in March 2020. Mr. Zhang is a private investor based in China. Mr. Zhang has served as a director of Wealth Power Global Trading Limited since June 2015. Mr. Zhang was nominated to our Board under the terms of a stockholders’ agreement entered into between the Company and CFL. The Board believes that Mr. Zhang is a valuable asset to the Board in light of his extensive experience in corporate governance.

Required Vote

In order to be elected to the Board, each nominee must receive a plurality of the voting power of the Company’s common stockCommon Stock present in person or represented by proxy at the 2016 annual meeting of stockholders and entitled to vote on the election of directors. This means that the director nominees who receive the highest number of votes “FOR” their election are elected.Annual Meeting. Stockholders may only vote “FOR”for or withhold their votes with respect tofor the election of the nominees to the Board. Votes that are withheld and broker non-votes will have no effect on the election of directors.

Recommendation of the Board of Directors

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF ALL OF THE NOMINEES AS DIRECTORS.

Meetings and Committees of the Board of Directors

Committees of the Board

Audit Committee. The affirmative voteAudit Committee was established for the purpose of a majorityoverseeing the Company’s accounting and financial reporting processes and audits of the shares represented atCompany’s financial statements. The Audit Committee’s primary functions are:

● | to assist the Board with the oversight of the Company’s financial reporting process, accounting functions and internal controls; and | |

● | the appointment, compensation, retention and oversight of the work of any registered public auditing firm employed by the Company for the purpose of preparing or issuing an audit report or related work. |

The Audit Committee currently consists of Courtney C. Shea (Audit Committee Chair), Michael Belsky and Chris Renn, each of whom is deemed independent under the 2016 annual meeting of stockholders and entitled to vote is required for the ratificationrules of the selection of Marcum LLP asNASDAQ Stock Exchange. The Audit Committee held 5 meetings in 2023. The Audit Committee meets periodically with the Company’s independent registered public accounting firm, forboth with and without management present. The Board has determined that Ms. Shea is an “audit committee financial expert” within the 2016 fiscal year. Abstentions will havemeaning of Item 407 of Regulation S-K under the same effect as a vote “AGAINST” this proposal,Exchange Act. A copy of the Audit Committee charter is posted and broker non-votes will have no effectavailable on the approvalCorporate Governance link of this proposal.

Compensation Committee. The affirmative vote ofCompensation Committee operates under a majority of our outstanding shares of common stock entitled to vote is required to approvecharter approved by the Reverse Stock Split Proposal. Abstentions and broker non-votes will have the same effect as a vote “AGAINST” this proposal.

● | ||||

annually reviewing and approving corporate goals and objectives relevant to Chief Executive Officer compensation, evaluating the Chief Executive Officer’s performance in light of | ||||

● | ||||

annually reviewing and approving the annual base salaries and annual incentive opportunities of | ||||

● | ||||

reviewing and approving the following as they affect the Chief Executive Officer and the other executive officers: (a) all other incentive awards and opportunities, including both cash-based and equity-based awards and opportunities; (b) any employment agreements and severance arrangements; and (c) any change-in-control agreements and change-in-control provisions affecting any elements of | ||||

● | monitoring and evaluating matters relating to the |

The size of our Board is currently set at nine, and the BoardCompensation Committee currently consists of seven directorsMichael D. Belsky (Compensation Committee Chair), Hao (Howard) Zhang and Courtney Shea. The Compensation Committee held no meetings during 2023 but acted by unanimous written consent a number of times during the year. The Compensation Committee also has authority to delegate its responsibilities to a subcommittee. The Company and the Compensation Committee may, from time to time, directly retain the services of consultants or other experts to assist the Company or the Compensation Committee, as the case may be, in connection with two vacancies. Ifexecutive compensation matters. The Compensation Committee does not believe the director nominees named in this proxy statement are elected,risks from the Board will continueCompany’s compensation policies and practices for its employees would be reasonably likely to consisthave a material adverse effect on the Company.

A copy of seven directors with two vacancies.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee operates under a charter approved by the Board. The Nominating and Corporate Governance Committee’s primary functions are:

● | discharging the responsibilities of the Board relating to the appropriate size, functioning and needs of the Board, including the identification of qualified individuals to serve as Board members; | |

● | leadership of the Board in its annual self-evaluation; and | |

● | development, implementation, and monitoring of the Company’s corporate governance guidelines; |

The fulfillment of the Nominating and Corporate Governance Committee’s primary functions include:

● | leading the search for individuals qualified to serve as members of the Board and conducting the appropriate inquiries with respect to such persons; | |

● | evaluating the size and composition of the Board and its committees and recommending any changes to the Board; | |

● | reviewing the qualifications of, and making recommendations regarding, director nominations submitted to the Company by stockholders; | |

● | reviewing the Board’s committee structure and recommending to the Board for its approval directors to serve as members of each committee; and | |

● | reviewing and recommending committee slates annually and recommending additional committee members to fill vacancies as needed. |

The Nominating and Corporate Governance Committee currently consists of Hao (Howard) Zhang (Nominating and Corporate Governance Committee Chair), Ge Yi, and Michael D. Belsky. The Nominating and Corporate Governance Committee held no in-person meetings during 2023. A copy of the charter of the Nominating and Corporate Governance Committee is posted and available on the Corporate Governance link of the Board, our Board has nominated the following six current directors: (i) Lee Hillman, (ii) Star Jones, (iii) James Kirsch, (iv) Stephen Pemberton, (v) Andrea Sáenz and (vi) David Schramm, and one director nominee, Katherine Butkevich, to be elected as directors at the 2016 annual meeting of stockholders. Directors are to be elected by a plurality voteInvestor Relations section of the voting powerCompany’s website, www.ipdnusa.com. Information on the Company’s website is not incorporated by reference herein.

Attendance at Board and Committee Meetings

During the fiscal year ended December 31, 2023, the Board held a total of our common stock present2 meetings in person oraddition to acting by proxy at the 2016 annual meeting of stockholders to serve until the next annual meeting of stockholders and until their successors have been duly elected and qualified. Proxies cannot be voted forunanimous written consent a greater number of persons than the number of the director nominees named in this proxy statement.

Our Board has reviewed the materiality of any relationship that each of our directors has with us, either directly or indirectly. Based on this review, our Boardboard has determined that each of the following current members of our Board: Messrs. Hillman, PembertonMr. Belsky, Mr. Zhang, Ms. Shea, Mr. Liu and Schramm and Mss. Sáenz and Zuckerberg, was “independent”Mr. Renn are “independent directors” as defined by Rule 5605(a)(2) of the Listing Rules of the Nasdaq Stock Market. In addition, each of Messrs. Feierstein and Marovitz, who resigned from our Board on June 29, 2016, and Ms. Brazile, who resigned from our Board on August 22, 2016, was “independent” as defined by Rule 5605(a)(2)Under the terms of the Listing Rules of the Nasdaq Stock Market. Other than as described below regarding our Board Representation Agreement with White Winston Select Asset Funds, LLC, we do not otherwise have any oral or writtenstockholders’ agreement with any company for representatives from any company to serve on our Board. See “Certain Relationshipsbetween CFL and Related Party Transactions — Master Credit Facility and Related Agreements” for further details on the Board Representation Agreement.

Board Leadership Structure

The Board does not have a policy requiring that the roles of Chief Executive Officer and Chairman of the Board be separate. The Board believes that the Company and its stockholders benefit when the Board is free to Executive Chairman and (ii)determine the appointment of Katherine Butkevich as our new CEO, we separated the offices of Chairmanmost appropriate leadership structure in light of the Boardexperience, skills and availability of directors and the Chief Executive Officer. The CEO is responsible for the strategic direction and the day-to-day leadership and performance of the Company, whileOfficer as well as other circumstances. Mr. Hao (Howard) Zhang was nominated as the Chairman of the Board provides guidanceby CFL pursuant to its right under the CEO, setsStockholders’ Agreement. Additionally, because all of the agenda forCompany’s five Board members and nominees have been determined by the Board meetings and presides over meetings of the Board. At this time,to be “independent,” the Board believes that its current structure provides sufficient independent oversight of management given the Company’s current leadership structure issize, and therefore, the best structureBoard has not designated a lead independent director.

Board Leadership Diversity

We are proud of the strength and diversity within our Board of Directors, comprised of 20% female directors and 60% of directors who are non-white as of December 31, 2023.

BOARD DIVERSITY | ||||||||

Board Diversity Matrix for: | Professional Diversity Network Inc. | |||||||

As of: | April 17, 2024 | |||||||

Total Number of Directors: | 5 | |||||||

Part I: Gender Identity | Female | Male | Non-Binary | Did Not Disclose Gender | ||||

Directors | 1 | 4 | 0 | 0 | ||||

Part II: Demographic Background | ||||||||

African American or Black | 0 | 0 | 0 | 0 | ||||

Alaskan Native or American Indian | 0 | 0 | 0 | 0 | ||||

Asian | 0 | 3 | 0 | 0 | ||||

Hispanic or Latinx | 0 | 0 | 0 | 0 | ||||

Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||

White | 1 | 1 | 0 | 0 | ||||

Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||

LGBTQ+ | 0 | 0 | 0 | 0 | ||||

Did Not Disclose Demographic Background | 0 | 0 | 0 | 0 | ||||

Board’s Role in Management of Risk

The Company faces numerous risks more fully described in the Company’s annual and quarterly reports filed with the SEC. The Company’s management bears responsibility for the day-to-day management of risks the Company as it enablesfaces and for communicating the most material risks to the Board to continue to benefit from Mr. Kirsch’s experience, skills, expertise and knowledgeits committees. The Board, as a whole and through its committees, is responsible for company-wide oversight of the Company and the industry.

Board Nominee Process

The Board has three standing Committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. During 2015, the Audit Committee met on four occasions, the Compensation Committee met on two occasions and theadopted a Nominating and Corporate Governance Committee met on two occasions. EachCharter, which includes the Company’s general director other than Donna Brazile, Stephen Pemberton and Randi Zuckerberg, attended 75% or more of the meetings of the Board and of the committees of which the director was a member.

The Nominating and Corporate Governance Committee (the “Nominating Committee”) operates under a charter approved by the Board, a copy of which is available on the Corporate Governance link of the Investor Relations section of our website, www.prodivnet.com.

The Nominating Committee is able to assess the effectiveness of the Company’s policy regarding diversity through its regular, required monitoring of the composition of the Board and its committees. Further, in connection with such regular monitoring, the Nominating Committee Charter specifically requires the Nominating Committee to determine whether it may be appropriate to add individuals with different backgrounds or skills to the Board.

The Nominating Committee may use multiple sources for identifying director candidates, including its own contacts and referrals from other directors, members of management, the Company’s advisors and executive search firms. The Nominating and Corporate Governance Committee will also consider director candidates recommended by stockholders in accordance with the procedures governing such recommendations in the Company’s bylaws and will evaluate such director candidates in the same manner in which it evaluates candidates recommended by other sources. Under our bylaws, if a stockholder wishes to submit a director candidate for consideration by the Nominating Committee, the stockholder must provide written notice delivered to the Secretary of the Company not less than 90 days nor more than 120 days prior to the anniversary date of the immediately preceding the annual meeting.

Stockholder Communication with the SEC on March 30, 2016, as amended. Our management bears responsibility forBoard of Directors

Stockholders may communicate with one or more directors or the day-to-day management of risks we face and for communicating the most material risks to the Board and its committees. The Board as a whole by sending written communications addressed to such person or persons to the Secretary, Professional Diversity Network, Inc., 55 E. Monroe Street, Suite 2120, Chicago Illinois, 60603, or by sending electronic mail to investors@ipdnusa.com. All communications will be compiled by the Secretary and through its committees, is responsible for overseeing and reviewing with management Company-wide risks andrelayed to the policies and practices established to manage such risks. The Board and its committees perform their risk management function principally through the receipt of regular reports from management and discussions with management regarding risk assessment and risk management. In its risk oversight role, the Board is responsible for satisfying itself that the risk management processes described and implemented by management are adequate and functioning as designed.

We have adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors.directors, including those officers responsible for financial reporting. The Codecode of Conductbusiness conduct and Ethicsethics is available on our internet web sitecorporate website at www.prodivnet.com under “Company-Investor Relations – Corporate Governance – Governance Documents.” We intendwww.ipdnusa.com. Any amendment to, provide disclosureor waiver from, a provision of any amendments or waiverssuch code of our Code of Ethicsethics will be posted on our website. Information on the Company’s website within four business days following the dateis not incorporated by reference herein.

Review of Related Party Transactions

The charter of the amendment or waiver.

In this section, we describe our compensation programs and policies and the material elements of compensation for the year ended December 31, 20152023 for our Chairman and Chief Executive Officer, and our two most highly compensated executive officers, other than our Chief Executive Officer, whose total compensation was in excess of $100,000. We refer to all individuals whose executive compensation is disclosed in this proxy statementherein as our “named executive officers.”

Our Compensation Committee is responsible for reviewing and evaluating the components of our compensation programs, including employee base salaries and benefit plans. The Compensation Committee will provide advice and recommendations to the Board on such matters. See “Corporate Governance — Compensation CommitteeGovernance-Meetings and Committees of the Board of Directors” for further details on the role of the compensation committee.

Compensation Committee.

The Company and the Compensation Committee may, from time to time, directly retain the services of consultants and other experts to assist the Company or the Compensation Committee in connection with executive compensation matters. Currently, the Company has not engaged any such compensation consultant.

Overview and Objectives of Compensation Program

The goal of the compensation program for our named executive officers is to retain and reward leaders who create long-term value for our stockholders. This goal affects the compensation elements we use and our compensation decisions. We have designed and implemented our compensation programs for our named executives to:

● | reward them for financial and operating performance; | |

● | align their interests with those of our stockholders; and | |

● | encourage them to remain with the Company. |

Our compensation elements simultaneously fulfill one or more of our performance, alignment and retention objectives. These elements consist of:

● | salary; | |

● | non-equity (cash) incentive compensation (“bonus”) based upon annually determined performance criteria; | |

● | equity incentive compensation consisting of restricted common stock and/or options, which may be based upon annually determined performance criteria (which may contain a time based vesting schedule); and | |

● | other benefits. |

In deciding on the type and amount of compensation for each executive, we focus almost exclusively on each executive’s current pay, rather than historic pay. We combine the compensation elements for each executive in a manner we believe optimizes the value for our stockholders and supports the goals of our compensation programs.

The following summarizes the compensation elements we use as tools to reward, retain and align the performance expectations of our named executives.

Base Salary and Discretionary Bonuses

Base salaries for our named executives are designed to provide competitive levels of compensation dependent on the scope of their responsibilities, their leadership skills and values, and their performance. For each named executive officer, we typically also grant discretionary bonuses either in cash and/or equity awards, for the prior year’s performance based upon management’s evaluation and the Compensation Committee’s qualitative assessment of each executive’s performance. This compensation element is in line with the stated goal of our compensation programs, namely retaining and rewarding leaders who create long-term value for our stockholders. The incentives are determined and approved by the Compensation Committee for performance against normalized corporate financial performance measures, such as revenue, EBITDA, adjusted EDITDA, and net income, in the committee’s discretion.

Long -Term Compensation — Equity Awards

We emphasize long-term variable compensation at the senior executive level because of our desire to reward effective long-term management and decision making and our desire to retain executive officers who have the potential to impact both our short-term and long-term profitability. We believe that providing Restricted Stock Units (RSUs) and Options are an effective means to focus our named executives on delivering long-term value to our stockholders. RSUs and Options allow us to reward and retain the named executives by offering them the opportunity to receive shares of our stock on the date the restrictions (if any) lapse as long as the named executive continues to be employed by the Company.

Other Compensation

We may provide our named executive officers with other benefits, reflected in the All Other Compensation column in the Summary Compensation Table if applicable, that we believe are reasonable, competitive and consistent with our overall compensation program and goals. The costs of these benefits constitute only a small percentage of each named executive officer’s total compensation. The named executive officers also may participate in the standard health insurance benefits offered to all employees.

Determination of Compensation

As part of our total overall compensation plan, the compensation for our named executive officers depends on the scope of their responsibilities, their leadership skills and values, and their individual performance, as well as the Company’s performance. Decisions regarding salary increases are affected by the named executives’ current salary and the amounts paid within and outside the Company. Base salary rates are reviewed on an annual basis and adjusted when appropriate by the Compensation Committee based upon changes in market conditions and the Company’s performance factors. When making decisions regarding compensation, we focus almost exclusively on each executive’s current pay, rather than historic pay.

The Compensation Committee exercises its discretion in initially making compensation decisions, after reviewing the performance of the Company and evaluating an executive’s prospects and performance during the year against established goals, operational performance, business responsibilities, and current compensation arrangements. The following is a summary of key considerations affecting the determination of compensation for the named executives:

Emphasis on Consistent Performance. Our compensation program provides a greater pay opportunity for executives who demonstrate superior performance for sustained periods of time. The amount of a named executive’s pay reflects the executive’s consistent contribution with the expectation of continued contribution to our success. Our emphasis on performance affects the discretionary annual cash bonus and equity incentive compensation awarded to the named executive. We incorporate current year and expected performance into our compensation decisions and percentage increases or decreases in the amount of annual compensation. For fiscal 2023, the criteria to determine overall compensation remained consistent with prior years and our stated philosophy.

Discretion and Judgment. We generally adhere to our historic practices in determining the amount and mix of compensation elements. Because of our reliance on the achievement of annual Company financial goals in determining the amount of plan-based compensation, short term changes in business performance can have a significant impact on the compensation of the named executive officers. We consider competitive market compensation paid by other companies of similar size and market capitalization, but we do not attempt to maintain a certain target percentile within a peer group or otherwise rely on data of peer companies to determine executive compensation.

We do not have any specific apportionment goal with respect to the mix between equity incentive awards and cash payments. We generally attempt to assess an executive’s total pay opportunities and whether we have provided the appropriate incentives to accomplish our compensation objectives. Our mix of compensation elements is designed to reward recent results and performance through a combination of non-equity (cash) and equity incentive awards. We also seek to balance compensation elements that are based on financial, operational and strategic metrics. We believe the most important indicator of whether our compensation objectives are being met is our ability to motivate our named executives to deliver superior performance and retain them.

Significance of Company Results. The Compensation Committee primarily evaluates the named executives’ contributions to the Company’s overall performance rather than focusing only on the named executive’s individual function. The Compensation Committee believes that the named executive officers share the responsibility to support the goals and performance of the Company, as the executive members of the Company’s leadership team. While this compensation philosophy influences all of the committee’s compensation decisions, it has the biggest impact on annual non-equity incentive awards and, generally, discretionary bonuses.

Consideration of Risk. Our compensation programs are discretionary, balanced and focused on rewarding performance for both the current year and contributions to achievement of the Company’s long-term strategy. Under this structure, a greater amount of compensation can be achieved through consistent superior performance over sustained periods of time. Long-term incentive plan compensation in the form of restricted stock may be subject to vesting restrictions in whole or in part. We believe this provides strong incentives for our named executive officers to manage the Company for the long term while avoiding excessive risk-taking in the short term. Goals and objectives reflect a balanced mix of quantitative and qualitative performance measures to avoid excessive weight on a single performance measure. The elements of compensation are mixed among current non-equity (cash) payments and equity awards. With limited exceptions, the Compensation Committee retains the ability to adjust compensation for quality of performance and adherence to our values. The Company does not believe that its compensation policies and practices are reasonably likely to have a material adverse effect on the Company.

Compensation for the Named Executive Officers in 2023

CEO Compensation

In determining Mr. He’s base salary compensation for 2023, the Compensation Committee considered his performance as CEO and the performance of the Company in fiscal year 2023. In addition, the Compensation Committee considered general trends of Company performance over the prior several years, outcomes related to growth and development activities and strategic initiatives and market conditions, as well as the responsibilities of the position and his strategic value to the Company. Mr. He and the Board continued to respond to the evolving economic conditions by focusing on the following performance framework (1) performing in a tough economic environment, (2) maintaining and maximizing financial flexibility, (3) optimizing sustainable cost containment and (4) protecting the Company’s reputation and long-term strategy. The Compensation Committee believes that Mr. He performed well in 2023 by executing on the established performance framework. The Compensation Committee believes Mr. He has performed at a high level and has approved his CEO salary at $250,000 annually. In determining his bonus for 2023, the committee noted that Mr. He's performance continued to be outstanding. In recognition of his leadership, he was awarded a $10,000 cash bonus and granted 13,289 shares of stock, valued at $40,000 as of the grant date on July 19, 2023. This grant, made under the 2023 Equity Compensation Plan, vested immediately upon issuance. Mr. He was also awarded 120,000 restricted stock units, of which 40,000 shares were vested upon the grant date and the remainder vests in equal installments upon the first two anniversaries of the grant date, in July 2023 upon the execution of a new employment agreement, as described in more detail below.

CFO Compensation

In determining the base salary compensation of Mr. Aichler for fiscal 2023 the Compensation Committee considered the same criteria as for the CEO. The Compensation Committee also considered the recommendations of the CEO based upon his evaluation of individual functional area responsibilities and goals. The non-equity incentive plan compensation was determined with the criteria for continued mitigation of revenue deterioration with sustainable cost containment, capital allocation discipline, continued strengthening of financial and technological internal controls, and execution against defined financial measures.

Mr. Aichler serves as our Chief Financial Officer of the Company. Mr. Aichler’s base salary was predicated on competitive market conditions for the scope of responsibility, leadership skills, and values. The Board of Directors approved a CFO salary of $180,000 annually. In determining the bonus portion of his compensation in fiscal 2023, the Compensation Committee determined that Mr. Aichler performed at a high level. In light of Mr. Aichler’s performance, he was given a $15,000 cash bonus and received 6,645 shares of stock valued at $20,000 as of the July 19, 2023 grant date, which related largely in part to his leadership performance. This grant was made pursuant to the 2023 Equity Compensation Plan and vested upon grant.

Summary Compensation Table

The following table provides information regarding the compensation earned during the years ended December 31, 20152023, 2022 and December 31, 20142021, by the persons who served as our Chairman and Chief Executive Officer and our two most highly compensated executive officers, other than our Chief Executive Officer, whose total compensation was in excess of $100,000.

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||

James Kirsch, | 2015 | $ | 327,438 | $ | 100,000 | — | $ | 9,504 | (2) | $ | 436,942 | |||||||||||

Chairman and Chief Executive Officer(1) | 2014 | $ | 256,250 | $ | 50,000 | — | $ | 9,504 | $ | 315,754 | ||||||||||||

Star Jones, | 2015 | $ | 300,000 | $ | — | — | $ | 24,895 | (2) | $ | 324,895 | |||||||||||

President, Chief | 2014 | $ | 80,769 | $ | — | $ | 5,361,347 | $ | 21,405 | $ | 5,463,521 | |||||||||||

Development Officer | ||||||||||||||||||||||

David Mecklenburger | 2015 | $ | 251,875 | $ | 50,000 | $ | — | $ | — | $ | 301,875 | |||||||||||

Chief Financial Officer | ||||||||||||||||||||||

Matthew Proman | 2015 | $ | 153,365 | $ | — | $ | — | $ | 221,750 | (2) | $ | 375,115 | ||||||||||

Former Chief Operating Officer | ||||||||||||||||||||||

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($)(1) | Option Awards ($)(1) | All Other Compensation ($) | Total ($) | ||||||||||||||||||

Xin (Adam) He, Chief Executive Officer | 2023 | $ | 250,000 | $ | 10,000 | $ | 160,400 | $ | - | $ | - | $ | 420,400 | ||||||||||||

2022 | $ | 235,808 | $ | - | $ | 39,789 | $ | - | $ | - | $ | 275,597 | |||||||||||||

2021 | $ | 220,000 | $ | 16,000 | $ | 21,450 | $ | - | $ | - | $ | 257,450 | |||||||||||||

Larry Aichler, Chief Financial Officer | 2023 | $ | 180,000 | $ | 15,000 | $ | 20,000 | $ | - | $ | - | $ | 215,000 | ||||||||||||

2022 | $ | 170,000 | $ | - | $ | 25,320 | $ | - | $ | - | $ | 195,320 | |||||||||||||

2021 | $ | 103,333 | $ | - | $ | 18,590 | $ | 32,550 | $ | - | $ | 154,473 | |||||||||||||

(1) | Amounts shown in this column represent stock awards made to |

| Compensation Program” herein. The amounts | |

He’s Employment Agreement

On July 18, 2023 (the “He Effective Date”), the Company entered into a new employment agreementsagreement (the “He Employment Agreement”) with James Kirsch,Mr. He, which will remain in effect until terminated in writing by either party or earlier terminated pursuant to the Company’s Executive Chairman, who served as its Chief Executive Officer through March 30, 2016; Star Jones,provisions of the Company’s President; and David Mecklenburger,He Employment Agreement. Under the Company’s Chief Financial Officer (each such agreement, an “Employment Agreement,” and collectively, the “Employment Agreements”).

Under the terms of the He Employment Agreements, each named executive officerAgreement, Mr. He is subject to anon-solicitation, non-competition and non-interference and non-raiding restrictive covenantcovenants during theirhis employment and 18 monthsfor the 12-month period following the named executive officer’s last day of employment with the Company. In the event that a named executive officer’s employment is terminated without “Cause” or the named executive officer resigns for “Good Reason” (as those terms are defined by thehis termination. The He Employment Agreements), the post-employment restrictive covenant period may not extend past the severance period (as described below). The Employment AgreementsAgreement also containcontains customary confidentiality, work product and return of Company property covenants.

In addition, Mr. He is entitled to severance pay in the event that such named executive officerif he is terminated without “Cause”“cause” or resigns for “Good Reason.“good reason,” each as defined in the He Employment Agreement. Upon such a termination, of employment, such named executive officer isMr. He will be entitled to continuereceive an amount equal to receive such named executive officer’s monthly30 days of his base salary, at his or her then current rateany earned but unpaid bonus for the greateryear prior to the year of six months ortermination, and the number of remaining whole months in such named executive officer’s term (whether the initial term or an extension), as well as a pro rata portion of any bonus based on the Company’s actual performanceearned for the year in which such termination occurs. Finally, Ms. Jones’ Employment Agreement also provides that she will become immediately fully vested in any unvested sharesoccurs, as well as continuation of restricted stock granted to her inapplicable benefits for a period of six months following his termination.

In connection with the merger with NAPW, Inc. upon her termination without “Cause” or her resignation for “Good Reason.”

Aichler’s Employment Agreement

On July 16, 2015,August 26, 2021, the Company entered into the Separationan employment agreement (the “Aichler Employment Agreement”) with Mr. Proman,Aichler, which will remain in effect until terminated in writing by either party or earlier terminated pursuant to the provisions of the Aichler Employment Agreement. Under the Aichler Employment Agreement, Mr. Aichler will receive an annual base salary of $160,000, subject to adjustment in the sole discretion of the Board or the Compensation Committee of the Board; provided however, that such annual base salary may not be decreased during Mr. Aichler’s employment period. Effective July 1, 2022, Mr. Aichler's annual base salary was increased to $180,000 at the direction of the Compensation Committee of the Board. Mr. Aichler will be eligible to receive an annual incentive bonus up to $90,000, based upon the assessment of the Company’s former Executive Vice President and Chief Operating Officer,Mr. Aichler’s performance. Mr. Aichler will also participate in connection with Mr. Proman’s resignation from his executive officer positions atall benefit plans and programs, subject to certain conditions and exceptions, as are generally provided by the Company and from the Board.

Under the terms of the SeparationAichler Employment Agreement, the Company agreedMr. Aichler is subject to pay to Mr. Proman lump-sum severance in the amount of $206,250, equal to the value of nine months ofnon-solicitation, non-competition and non-interference restrictive covenants during his annual salary, less all legally required payroll deductions. The Company also agreed to reimburse Mr. Promanemployment and for the amount of any premiums for individual medical insurance for Mr. Proman that are paid by Mr. Proman under the Consolidated Omnibus Budget Reconciliation Act (COBRA) during the nine-month12-month period following his termination. The Aichler Employment Agreement also contains customary confidentiality, work product and return of Company property covenants.

In connection with the dateapproval of the Separation Agreement.Aichler Employment Agreement, Mr. Proman released and discharged the Company and its officers, directors, employees and agents from any and all claims, whether now known or unknown, which Mr. Proman then had or had had based upon or arising out of any matter occurring or existing at any time upAichler also received 15,000 stock options to and including the date of the Separation Agreement. The Company likewise released and discharged Mr. Proman from any and all claims, whether then known or unknown, which the Company then had or had had based upon or arising out of any matter occurring or existing at any time up to and including the date of the Separation Agreement. In addition, the parties agreed that (i) the warrant to purchase 50,000 shares of the Company’s common stock for $4.00 per share, (ii) the warrant to purchase 131,250 shareswith an exercise price of the Company’s common stock for $10.00 per share and (iii)$4.20. The options to purchase 183,000 shares of the Company’s common stock at $3.45 per share, received by Mr. Promanvested in connection with the merger with NAPW, shall expire three calendar years from the date of the Separation Agreement.

The following table sets forth the equity awards we have made to our named executive officers that were outstanding as of December 31, 2015:

| Option Awards | Stock Awards | |||||||||||||||||||||

| Name | Number of Securities Underlying Unexercised Options (#) exercisable | Number of Securities Underlying Unexercised Options (#) unexercisable | Option Exercise Price ($) | Option Expiration Date | Number of shares of stock that have not vested (#) | Market Value of shares or units that have not vested | ||||||||||||||||

James Kirsch | — | — | — | — | — | |||||||||||||||||

Star Jones | — | — | — | 639,397 | (1) | $ | 319,699 | (2) | ||||||||||||||

David Mecklenburger | 10,000 | 20,000 | (3) | $ | 3.45 | 3/31/2024 | — | — | ||||||||||||||

Matthew Proman | 183,000 | 0 | $ | 3.45 | 9/24/2019 | — | — | |||||||||||||||

Option Awards (1) | Stock Awards (2) | ||||||||||||||||||||

Name | Number of Securities Underlying Unexercised Options (#) exercisable | Number of Securities Underlying Unexercised Options (#) unexercisable | Option Exercise Price | Option Expiration Date | Number of shares of stock that have not vested | Market Value of shares or units that have not vested | |||||||||||||||

($) | (#) | ($) | |||||||||||||||||||

Xin (Adam) He | 15,000 | - | $ | 4.46 | 3/11/2029 | 80,000 | $ | 162,400 | |||||||||||||

Larry Aichler | 10,000 | 5,000 | $ | 4.20 | 6/13/2031 | - | $ | - | |||||||||||||

(1) | Option Awards were granted |

(2) | Stock Awards were granted pursuant to our 2023 Equity Compensation Plan. See also Note 13 —Stock-Based Compensation to the |

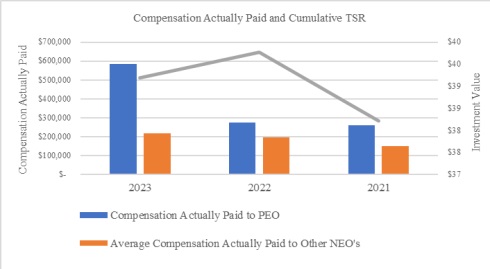

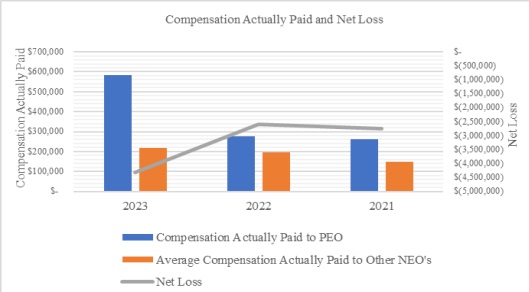

Pay versus Performance

As required by Item 402(v) of Regulation S-K, we are providing the following information regarding the relationship between executive compensation and our financial performance for each of the last two completed fiscal years. In determining the “compensation actually paid” to our named executive officers in the table below, we are required to make various adjustments to amounts reported in the Summary Compensation Table for this year and in previous years, as the SEC’s valuation methods for this section differ from those required in the Summary Compensation Table. The “compensation actually paid” data reflected in the table below may not reflect amounts actually realized by our named executive officers. For information concerning the decisions made by our Compensation Committee with respect to compensation for the named executive officers for each fiscal year, please see the disclosure under “Determination of Compensation” above and the other narrative disclosure under the “Executive Compensation” section of this proxy statement.

The following table summarizes compensation paid to our principal executive officer (“PEO”) as set forth in our Summary Compensation Table, the adjusted values of compensation actually paid (“CAP”) to our PEO, average compensation paid to our named executive officers other than our PEO as set forth in our Summary Compensation Table, and the adjusted values of average CAP to our named executive officers other than our PEO, each as calculated in accordance with SEC rules, as well as certain Company performance measures, in each case for the three fiscal years ended December 31, 2023:

Year (1) | Summary Compensation Table Total for PEO ($)(2) | Compensation Actualy Paid to PEO ($)(3) | Average Summary Compensation Table Total for Non-PEO Named Executive Officers ($)(2) | Average Compensation Actually Paid to Non-PEO Named Executive Officers ($)(3) | Value of Initial Fixed $100 investment Based on Total Shareholder Return ($)(4) | Net Loss ($)(5) | ||||||||||||||||||

2023 | $ | 420,400 | $ | 582,800 | $ | 215,000 | $ | 216,980 | $ | 39 | $ | (4,311,299 | ) | |||||||||||

2022 | $ | 275,597 | $ | 275,597 | $ | 195,320 | $ | 196,310 | $ | 40 | $ | (2,602,722 | ) | |||||||||||

2021 | $ | 257,450 | $ | 260,570 | $ | 153,027 | $ | 147,612 | $ | 38 | $ | (2,756,983 | ) | |||||||||||

In each of the years presented in the table, Xin (Adam) He served as our Chief Executive Officer. Our other NEOs consisted of Larry Aichler, who served as Chief Financial Officer in both 2023 and 2022, and both Larry Aichler and Chad Hoersten, our Chief Technology Officer at the time, in 2021.

The table below provides the adjustments to the Summary Compensation Table total compensation to arrive at the compensation actually paid to the PEO and the average for non-PEO named executive officers:

PEO | Average Non-PEO | |||||||

Adjustments to Determine "Compensation Actually Paid" | 2023 | 2023 | ||||||

Deduction for Amounts Reported under the "Stock Awards" and Option Awards Columns in the SCT | $ | (160,400 | ) | $ | (20,000 | ) | ||

Increase in Fair value of Awards Granted during the year that Remain Unvested as of Year end | $ | 162.400 | - | |||||

Increase for Fair Value of Awards Granted during Year that Vest during Year | $ | 160,400 | $ | 20,000 | ||||

Increase/deduction for change in Fair Value from Prior Year-end to Current Year-end of Awards Granted Prior to the Year that were Outstanding and Unvested as of Year-end | $ | 1,320 | ||||||

Increase/deduction for change in Fair Value from Prior Year-end to Vesting Date of Awards Granted Prior to the Year that Vested during Year | - | $ | 660 | |||||

Total Adjustments | $ | 162,400 | $ | 1,980 | ||||

The following charts compare the relationship of the compensation actually paid to our CEO and the average compensation actually paid to our named executive officers other than our CEO to our total shareholder return (TSR) and our net income for the periods indicated.

Relationship Between CAP and TSR

Relationship Between CAP and Net Income

Director Compensation

During 2015, 2023, we paid our non-employee directors the following fees in cash: (1) $500 or $1,500$5,000 annual retainer fee, (2) $25,000 of Restricted Stock Units which vest after one year, (3) a $1,000 retainer for each Board meeting attended telephonically or in person, respectively, (2) $500 for each Committee meeting attended, (3) $2,500 forthose directors serving on the Audit Committee and $5,000a $4,000 retainer for serving as the Audit Committee Chair, and (4) $1,000a $500 retainer for those directors serving on the Compensation Committee and a $1,000 retainer for serving as the Compensation Committee Chair. In addition, during 2015 non-employee directors received option grants with a grant date fair value of $25,000. The Audit Committee Chair and the Compensation Committee Chair, received an additional option grant withand (4) a grant date fair value of $25,000$500 retainer for those directors serving on the Nominating and $10,000, respectively.

The following table details the total compensation earned by the Company’s non-employee directors in 2015:

| Name | Fees Earned or Paid in Cash ($) | Option Awards ($)(6) | All Other Compensation ($) | Total ($) | |||||||||||||||

Donna Brazile | $ | 3,000 | (1) | $ | 9,541 | $ | - | $ | 12,541 | ||||||||||

Daniel Marovitz | $ | 16,000 | (2) | $ | 13,357 | $ | - | $ | 29,357 | ||||||||||

Stephen Pemberton | $ | 8,000 | (3) | $ | 9,541 | $ | - | $ | 17,541 | ||||||||||

Barry Feierstein | $ | 11,375 | (4) | $ | 9,922 | $ | 83,400 | (7) | $ | 104,697 | |||||||||

Andrea Sáenz | $ | 6,125 | (5) | $ | 9,541 | $ | - | $ | 15,666 | ||||||||||

Randi Zuckerberg | $ | 2,000 | (1) | $ | 9,541 | $ | - | $ | 11,541 | ||||||||||

2023 | ||||||||||||

Fees Earned or | All Other | |||||||||||

Paid in Cash | Compensation | Total | ||||||||||

($) | ($) | ($) | ||||||||||

Michael Belsky | 8,000 | 25,000 | 33,000 | |||||||||

Scott Liu | 6,000 | 25,000 | 31,000 | |||||||||

Chris Renn | 7,000 | 25,000 | 32,000 | |||||||||

Courtney C. Shea | 10,500 | 25,000 | 35,500 | |||||||||

Hao (Howard) Zhang | 7,500 | 25,000 | 32,500 | |||||||||

(1) | Amounts shown in the “Fees Earned or Paid in Cash” column represent the sum of all annual board service and committee fees earned or cash payments made to the indicated non-employee directors during |

(2) | Amounts shown in “Stock Awards” represent Restricted Stock Units granted pursuant to our 2023 Equity Compensation Plan. The amounts for |

Name and Address of Beneficial Owner | Number of Shares Beneficially Owned | Percent of Class Owned(1) | |||||

| 5% Stockholders | |||||||

White Winston Select Asset Funds, LLC | 2,750,000 | (2) | 15.93% | ||||

Daniel Ladurini | 2,290,541 | (3) | 15.78% | ||||

North Star Investment Management Corporation | 1,563,977 | (4) | 10.78% | ||||

Matthew B. Proman | 2,011,647 | (5) | 13.52% | ||||

Executive Officers and Directors | |||||||

Katherine Butkevich | - | - | |||||

Lee Hillman | 20,000 | (6) | * | ||||

Star Jones | 960,596 | 6.62% | |||||

James Kirsch | 1,507,288 | (7) | 10.13% | ||||

David Mecklenburger | 24,500 | (8) | * | ||||

Stephen Pemberton | 8,435 | (9) | * | ||||

Andrea Sáenz | 9,180 | (10) | * | ||||

David Schramm | 60,000 | (11) | * | ||||

Randi Zuckerberg | 5,102 | (12) | * | ||||

| Directors and executive officers as a group (10 persons) | 2,834,875 | (13) | 19.00% | ||||

The Audit Committee of the Board has appointed Marcum LLPSassetti, LLC (“Sassetti”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016.

Although the Company’s governing documents do not require the submission of this matter to our stockholders, the Board of Directors considers it desirable that the appointment of Marcum LLPSassetti be ratified by ourthe stockholders. In addition, even if the stockholders ratify the selection of Marcum LLP,Sassetti, the Audit Committee may in its discretion appoint a different independent registered public accounting firm at any time during the year if the Audit Committee determines that a change is in the best interests of the Company.

Representatives of MarcumSassetti are expected to attend the 2016 annual meeting of stockholders, whereAnnual Meeting to make such statements as they will be available tomay desire and respond to appropriate questions that may be asked by stockholders.

The Audit Committee and if they desire,the Board recommend that you ratify this appointment.

Vote Required

The affirmative vote of a majority of the voting power of Common Stock present in person or by proxy and entitled to make a statement.

Board of Directors Recommendation

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR”“FOR” PROPOSAL 2.

Principal Accountant FeesPROPOSAL 3: ADVISORY VOTE ON EXECUTIVE COMPENSATION

(Say-On-Pay)

The Dodd-Frank Wall Street Reform and Services

As described in more detail above, our executive compensation program is comprised principally of salary, long-term equity awards and cash or stock bonuses designed to: (i) attract, motivate and retain key executives who are critical to our success, (ii) align the interests of our executives with stockholder value and our financial performance and (iii) achieve a balanced package that would attract and retain highly qualified senior officers and appropriately reflect each such officer’s individual performance and contributions. In addition, the Company regularly reviews its compensation program and the overall compensation package paid to each of its senior executives to assess risk and to confirm that the structure is still aligned with the Company’s long-term strategic goals.

Before you vote on the resolution below, please read the entire “Executive Compensation” section, including the tables, together with the related narrative disclosure and footnotes, beginning on page 11 of this Proxy Statement. Note, as a “smaller reporting company,” we are obligated to provide compensation disclosures pursuant to Item 402 (m) through (q) of Regulation S-K promulgated under the Security Exchange Act of 1934 (“Regulation S-K”). Even though, as a smaller reporting company, we are exempt from compensation discussion and analysis by Marcum LLP for the fiscal years ended December 31, 2015executive compensation requirements of Item 402(b) of Regulation S-K, we have provided narrative information regarding our objectives and 2014, respectively.

| Fees | 2015 | 2014 | ||||||

Audit Fees | $ | 219,729 | $ | 150,988 | ||||

Audit-Related Fees | 47,350 | 35,400 | ||||||

Tax Fees | — | — | ||||||

All Other Fees | — | 140,000 | ||||||

Total | $ | 267,079 | $ | 326,388 | ||||

For the fiscalreasons provided, the Board is asking stockholders to cast a non-binding, advisory vote FOR the following resolution:

“RESOLVED, that stockholders approve the compensation paid to our named executive officers set forth under the caption “Executive Compensation” in this Proxy Statement (including the compensation tables and related narrative discussion).”

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” PROPOSAL 3.

PROPOSAL 4:ADVISORY VOTE ON FREQUENCY OF FUTURE ADVISORY VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

(Say-On-Frequency)

The Dodd-Frank Act, also provides that shareholders must be given the opportunity every six years ended December 31, 2015 and 2014,to vote, on an advisory, non-binding basis, for their preference as to how frequently we should seek future advisory votes on the “Audit Fees” reported above were billed by Marcum LLP for professional services rendered for the auditcompensation of annual financial statements, reviews of quarterly financial statements and for services normally provided by the independent auditors in connection with statutory and regulatory filings and engagements.

The Board has determined that an annual advisory Say-on-Pay vote will allow the Company’s shareholders to provide timely, direct input on the Company’s executive compensation philosophy, policies, and practices as disclosed in the proxy statement each year. The Board believes that an annual vote is therefore consistent with the Company’s efforts to engage in an ongoing dialogue with shareholders on executive compensation and corporate governance matters.

The Company recognizes that shareholders may have different views as to the best approach for the Company, and therefore the Company looks forward to hearing from shareholders as to their preference on the frequency of fees attributableholding future Say-on-Pay votes.

This vote is advisory, which means that the vote is not binding on the Company, the Board, or the Compensation Committee. The Board and the Compensation Committee will take into account the outcome of the vote, however, when considering the frequency of future advisory votes on Say-on-Pay.

Although the Board recommends a “say-on-pay” vote every year, shareholders are not voting to such services. During 2015, all services performed by Marcum LLP which were subjectapprove or disapprove of the Board’s recommendation. Shareholders will be able to pre-approval requirements were approved byspecify one of four choices for this proposal on the Audit Committee.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “1 YEAR” ON PROPOSAL 4.

The following table provides the name, age and position of each of our executive officers. There are no family relationships between or among our executive officers and directors.

Name | Age | Position | ||

Xin (Adam) He | 51 | Chief Executive Officer | ||

Larry S. Aichler | 56 | Chief Financial Officer |